CONNECT WITH A 1031 EXCHANGE ADVISOR

We take responsibility of connecting our investors to the best 1031 Exchange advisors. Fill the form now and one of our 1031 Exchange advisors will connect with you shortly.

Call 888-993-0590

GET CONNECTED TO 1031 ADVISOR

What Is A 1031 Exchange?

Since the introduction of Section 1031 of IRC, tax deferment on capital gains has become a common practice among the investors in the USA. This unique tax law allows investors to defer capital gains taxes on exchanging ‘like-kind’ properties. In a 1031 exchange, no loss or gain is recognized because the proceeds obtained from the relinquished property is reinvested on replacement properties. Consequently, investors get the benefit of deferring capital gains taxes.

Experience in Section 1031 exchange securitized real estate

Careful due diligence

Full disclosure of all details and parties

The security of bonded, reputable, qualified intermediaries

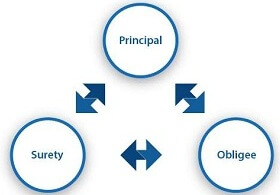

Who Is A Qualified Intermediary?

An investor must involve a Qualified Intermediary for carrying out a ‘like-kind’ exchange. A Qualified Intermediary holds the proceeds obtained from the sale of the relinquished property and reinvests it on replacement property. The entire exchange will be invalid if an investor receives cash upon selling the relinquished property.

What Is A Triple Net (NNN) Lease?

‘NNN’ stands for Net-Net-Net. ‘Net Lease’ can be of three types – single net, double net, and triple net depending upon what kind of property expenses the tenant is paying. For example, the reason why a ‘triple-net lease’ is called so is that in such arrangement, the tenant is required to pay the property taxes, insurance, and maintenance cost of the property, which are known as ‘three nets’.

What Is A Delaware Statutory Trust (DST)?

A ‘Delaware Statutory Trust’ is a legal entity set up for business purposes. It is established under the Delaware Statutory Trust Act, 1988 and recognized by Delaware state law. A Delaware Statutory Trust is formed as a private governing agreement under which a property is managed, held, administered, and invested.